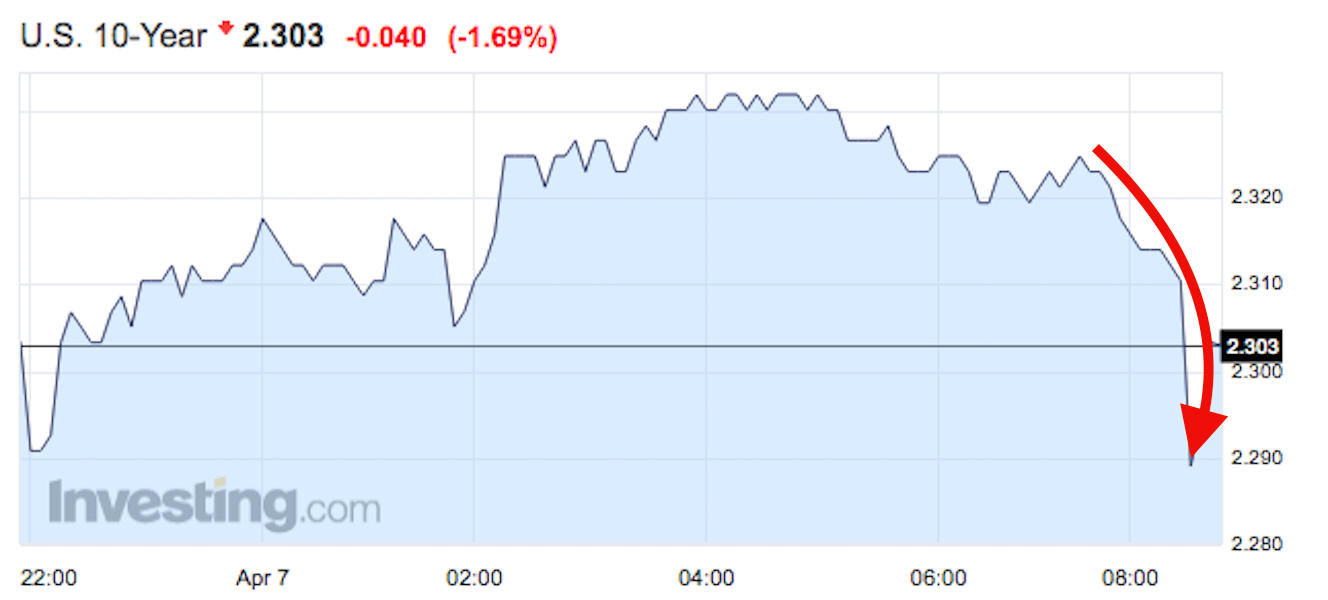

US Treasury yields are tumbling after the jobs report came in well below expectations. The Bureau of Labor Statistics says the US economy added 98,000 jobs in March, missing the 180,000 that was expected by the Bloomberg consensus.

Moderate buying has yields in the belly of the curve leading the way lower, down more than 4 basis points. Here’s a look at the scoreboard as of 8:49 a.m. ET:

- 2-year -0.8 bps @ 1.230% 3-year -1.7 bps @ 1.425% 5-year -3.6 bps @ 1.822% 7-year -3.9 bps @ 2.106% 10-year -4.2 bps @ 2.299% 30-year -3.6 bps @ 2.950%

Friday’s buying has pushed longer dated yields to their lowest level since the week following Donald Trump’s election victory. The benchmark 10-year yield hit a high of 2.64% in mid-March amid hope that President Trump’s protectionist trade agenda and plans to cut taxes and roll back regulations would bring back inflation to the United States.

Up front, yields haven’t come in as much as traders remain optimistic the Fed will meet its target of two more rate hikes in 2017. Friday’s action has the 2-year yield near its lowest level in six weeks.

Ahead of the jobs report, World Interest Rate Probability data provided by Bloomberg showed a 66.5% chance the Fed would hike rates at the June meeting or sooner. That has fallen to 60% after the jobs report.